A mechanism connected with the audit of the non-financial aspects of the business impact on the performance of the company and verifies compliances of applicable laws, regulations and guidelines.

The Secretarial Audit calls for an independent verification of the records, books, papers and documents by a Practicing Company Secretary to check the compliance status of the company according to the provisions of various statutes, laws and rules & regulations and also to ensure the compliance of legal and procedural requirements and processes followed by the company.

Applicability of Secretarial Audit

- Every listed company and their material unlisted subsidiaries incorporated in India.

- Every public company having a paid-up share capital of fifty crore rupees or more.

- Every public company having a turnover of two hundred fifty crore rupees or more.

- A private company which is a subsidiary of a public company, and which falls under the above mentioned class of companies.

The companies, which are not mandatorily covered under the provisions of the Companies Act, 2013, may opt for conducting Secretarial Audit voluntarily as it provides an independent assurance of the compliances of applicable laws by the company.

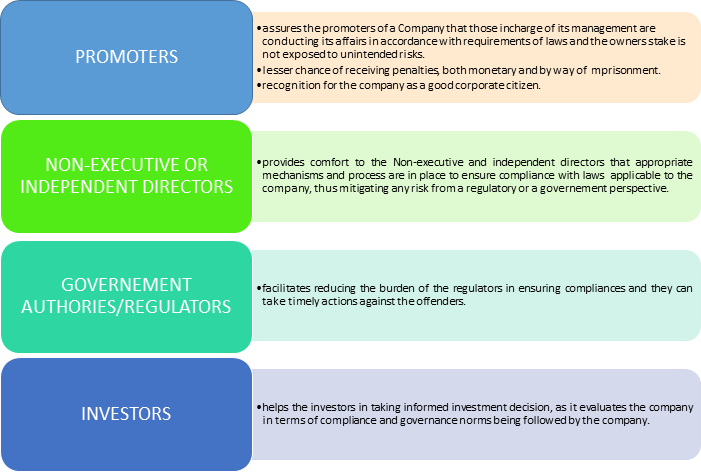

Benefits of a Secretarial Audit

We at NNS provide complete range of:

- Secretarial Audit for Public Sector Undertakings, Listed & Unlisted Public Limited Companies including Domestic & Multinational Corporate Houses.

- Due Diligence, Management Compliance Audit

- Undertake Specific projects Audit and Due Diligence assignments that require our observations and opinion on a particular assignment / projects.